FMLens: Towards Better Scaffolding the Process of Fund Manager Selection in Fund Investments

Longfei Chen -

Chen Cheng -

He Wang -

Xiyuan Wang -

Yun Tian -

Xuanwu Yue -

Wong Kam-Kwai -

Haipeng Zhang -

Suting Hong -

Quan Li -

DOI: 10.1109/TVCG.2024.3394745

Room: Bayshore V

2024-10-17T14:51:00ZGMT-0600Change your timezone on the schedule page

2024-10-17T14:51:00Z

Fast forward

Full Video

Keywords

Financial Data, Fund Manager Selection, Visual Analytics

Abstract

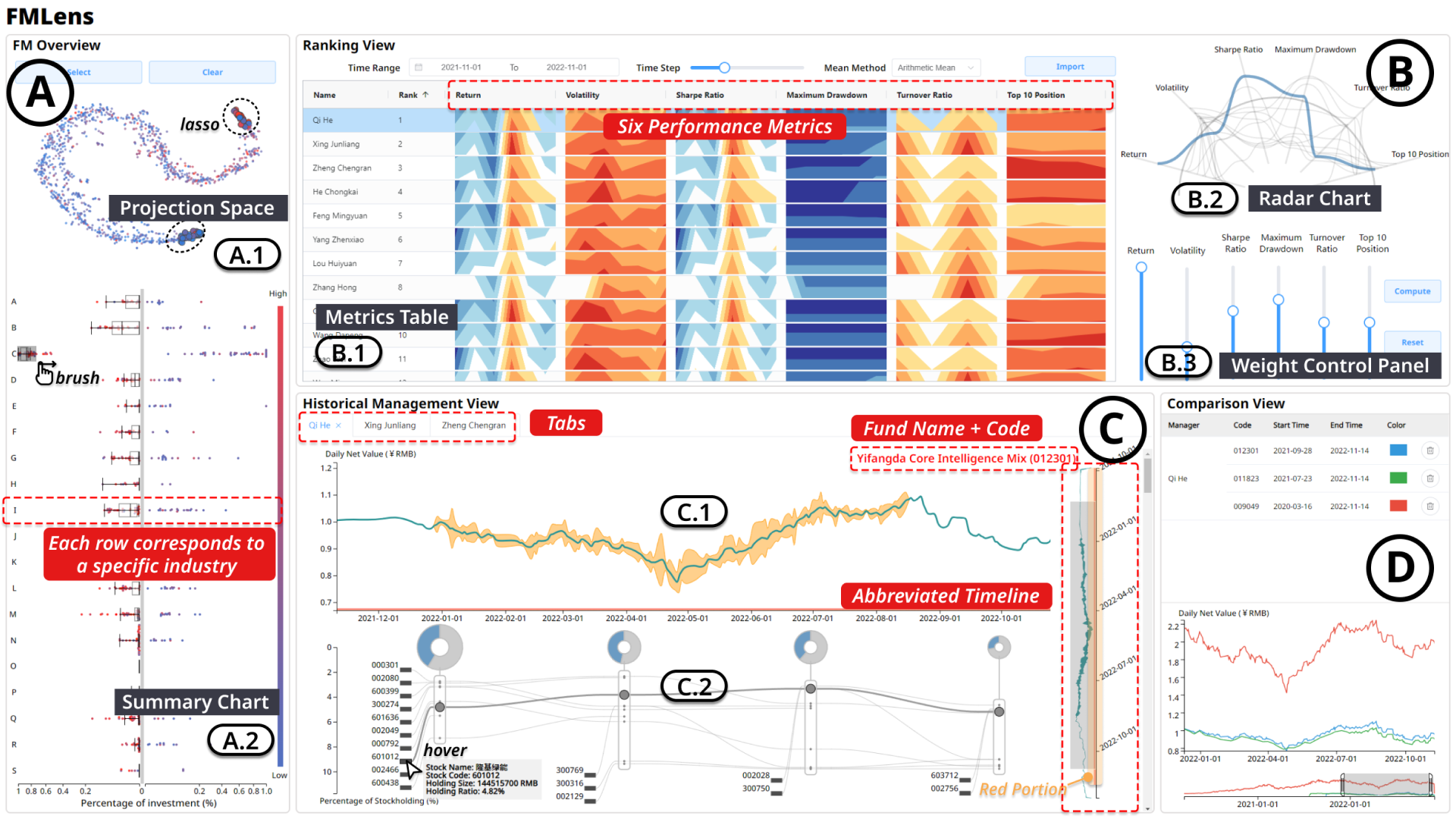

The fund investment industry heavily relies on the expertise of fund managers, who bear the responsibility of managing portfolios on behalf of clients. With their investment knowledge and professional skills, fund managers gain a competitive advantage over the average investor in the market. Consequently, investors prefer entrusting their investments to fund managers rather than directly investing in funds. For these investors, the primary concern is selecting a suitable fund manager. While previous studies have employed quantitative or qualitative methods to analyze various aspects of fund managers, such as performance metrics, personal characteristics, and performance persistence, they often face challenges when dealing with a large candidate space. Moreover, distinguishing whether a fund manager's performance stems from skill or luck poses a challenge, making it difficult to align with investors' preferences in the selection process. To address these challenges, this study characterizes the requirements of investors in selecting suitable fund managers and proposes an interactive visual analytics system called FMLens. This system streamlines the fund manager selection process, allowing investors to efficiently assess and deconstruct fund managers' investment styles and abilities across multiple dimensions. Additionally, the system empowers investors to scrutinize and compare fund managers' performances. The effectiveness of the approach is demonstrated through two case studies and a qualitative user study. Feedback from domain experts indicates that the system excels in analyzing fund managers from diverse perspectives, enhancing the efficiency of fund manager evaluation and selection.